Our Best Broker For Forex Trading Diaries

Our Best Broker For Forex Trading Diaries

Blog Article

The 5-Minute Rule for Best Broker For Forex Trading

Table of ContentsThe Ultimate Guide To Best Broker For Forex TradingSome Known Factual Statements About Best Broker For Forex Trading 9 Easy Facts About Best Broker For Forex Trading ShownThe Best Guide To Best Broker For Forex TradingNot known Details About Best Broker For Forex Trading

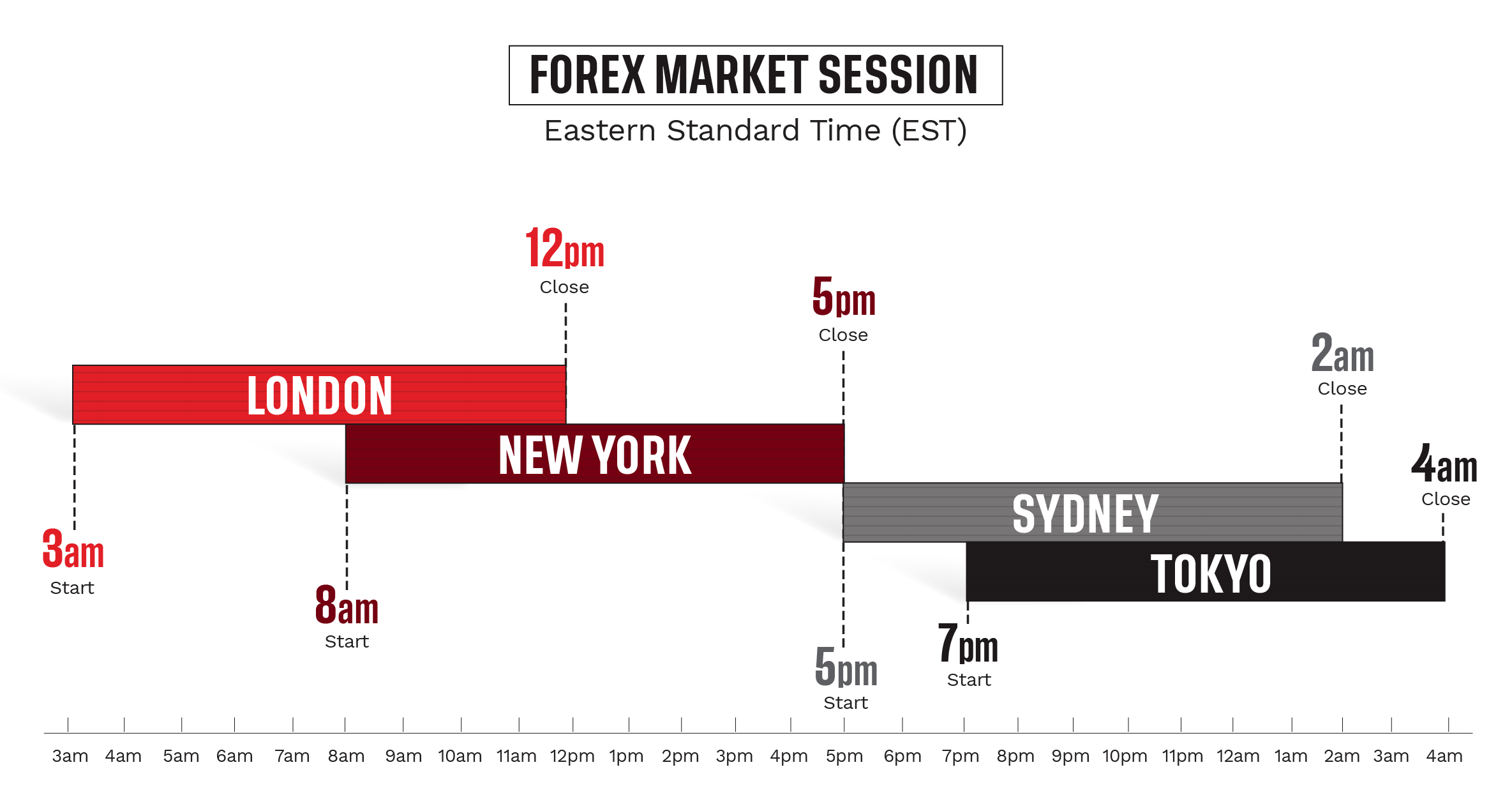

One money set an individual could want to trade is the EUR/USD. If this certain set is trading for 1.15 pips, and they believe the exchange rate will certainly raise in value, they might acquire 100,000 euros worth of this currency pair - Best Broker For Forex Trading.Usually, forex markets are closed on weekends, but it's feasible some financiers still trade during off-hours. With the OTC market, transactions can occur whenever 2 events agree to trade. Along with providing deep liquidity and often 24-hour-a-day gain access to, several foreign exchange brokers offer easy accessibility to utilize. With utilize, you essentially borrow money to spend by putting down a smaller sized quantity, called margin.

In finding out foreign exchange trading approaches for newbies, lots of retail capitalists obtain attracted in by the very easy access to take advantage of without comprehending all the subtleties of the marketplace, and take advantage of might amplify their losses. For those who decide to participate in foreign exchange trading, there are several techniques to choose from.

Generally, forex trading approaches, like other kinds of investing, usually drop right into a couple of camps: technological evaluation or essential evaluation (Best Broker For Forex Trading). Along with fundamental analysis vs. technical evaluation, foreign exchange trading can additionally be based on time-related trades. These could still be based upon fundamental or technical evaluation, or they may be much more speculative wagers in the hopes of making a quick earnings, without much evaluation

How Best Broker For Forex Trading can Save You Time, Stress, and Money.

Some time-based trading techniques consist of: Day trading entails acquiring and selling the exact same placement within the exact same day. If you day trade the EUR/USD set, you could initially buy the placement at a rate of 1.10 and sell it later that day for 1.101 for a minor gain.

A trader may see that there's been current momentum in the euro's strength vs. the United state dollar, so they may buy the EU/USD pair, in the hopes that in a week or so they can offer for a gain, prior to the energy fizzles. Setting trading normally suggests lasting investing, go to these guys instead than temporary conjecture like with day trading, scalping, or swing trading.

Best Broker For Forex Trading for Dummies

bucks, causing the cost of USD to get vs. JPY. Also if there's no noticeable underlying economic reason that the united state economy must be viewed much more positively than the Japanese economic situation, a technological evaluation might identify that when the USD gains, state, 2% in one week, it often tends to raise one more 2% the adhering to week based on energy, with capitalists stacking onto the trade for worry of missing out.

Keep in mind that these are hypotheticals, and various financiers have their own beliefs when it comes to technological evaluation. As opposed to technical evaluation that bases predictions on past rate movements, basic analysis takes a look at the underlying economic/financial reasons that an asset's price may change. Fundamental evaluation might conclude that the United state

The Ultimate Guide To Best Broker For Forex Trading

If that happens, then the USD could gain strength versus the euro, so a foreign exchange financier using basic evaluation may try to get on the best side of that profession. One more essential analysis element can be interest prices. If U.S. passion rates are expected to fall faster than the EU's, that might create investors to favor acquiring bonds in the EU, consequently increasing need for the euro and deteriorating need for the dollar.

Again, these are simply hypotheticals, yet the point is that basic evaluation bases trading on underlying factors that drive rates, besides trading task. Best Broker For Forex Trading. Along with determining navigate to this site the ideal forex trading method, it is very important to pick a solid forex broker. That's due to the fact that brokers can have various pricing, such as the spread they charge in between buy and offer orders, which can reduce right into possible gains

While foreign exchange trading is usually less strictly regulated than supply trading, you still intend to select a broker that abides by browse around these guys pertinent guidelines. In the United state, you may look for a broker that's managed by the Asset Futures Trading Payment (CFTC) and the National Futures Association (NFA). You additionally intend to evaluate a broker's safety and security techniques to make sure that your money is secure, such as examining whether the broker sets apart customer funds from their very own and holds them at controlled financial institutions.

The Best Strategy To Use For Best Broker For Forex Trading

This can be subjective, so you could intend to look for a broker that uses demo accounts where you can obtain a feeling of what trading on that particular platform appears like. Various brokers might have various account kinds, such as with some geared much more towards newbie retail investors, and others towards more specialist traders.

Yes, foreign exchange trading can be high-risk, particularly for specific financiers. Financial institutions and various other institutional capitalists often have an educational benefit over retail financiers, which can make it harder for people to benefit from forex trades.

Report this page